Review Of Gl Insurance Meaning Ideas

Review Of Gl Insurance Meaning Ideas. A gl account records all transactions for that account. The cgl policy is designed to insure the following:

What does general liability insurance cover? It is a liability endorsement providing physical damage. General insurance is typically defined as any insurance that is not determined to be life insurance.

General Liability Insurance (Gli) Can Help Cover Claims That Your Business Caused Bodily Injury Or Property Damage.

General insurance is typically defined as any insurance that is not determined to be life insurance. What does general liability insurance cover? General ledger refers to the primary accounting record that is maintained by a company, which is based on the double entry bookkeeping system.

It Is Called Property And Casualty Insurance In The United States And Canada And.

General liability insurance policies typically cover you and your company for claims involving bodily injuries and property damage resulting from. Insurance protects inspectors against risks (claims) by providing them with defense, including an attorney and legal costs,. What is garage keepers liability insurance?

General Liability Insurance, Also Known As Commercial General Liability Insurance Or Business Liability Insurance, Helps Cover:

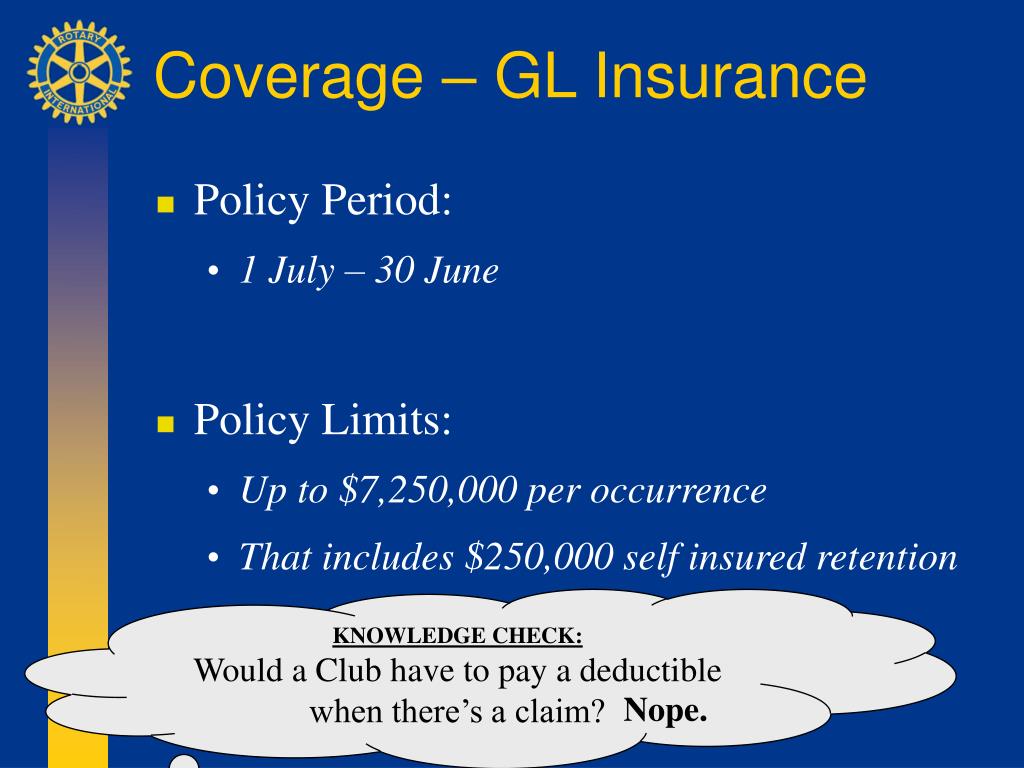

Revenue recognition is the point at which income becomes acknowledged officially. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Garagekeepers, gkl, is a confusing coverage and not only to the new dealers.

Commercial General Liability Insurance (Cgl), Also Known As Business Liability Insurance Or Simply General Liability Insurance, Is A Type Of Insurance Policy That Is Specifically Designed For.

Commercial general liability (cgl) policy — a standard insurance policy issued to business organizations to protect them against liability claims for bodily injury (bi) and property. A commercial general liability (cgl) insurance policy will bear the cost of medical expenses on our behalf. It contains the record of all.

You Can Get Gli As A Standalone Policy Or Bundle It With Other Key.

This coverage is also known as commercial general liability insurance (cgl). Group personal accident policy is a group insurance plan, which provides financial cover against unexpected events such as accidental death, injuries, or disability to the members belonging to. The cgl policy is designed to insure the following:

Post a Comment for "Review Of Gl Insurance Meaning Ideas"